Bulenox Insights: All About the Two Types of Funded Accounts

A prop firm offering two distinct account types: Bulenox grants you access to the futures markets with at least one option tailored to your trading style.

Bulenox: Differences Between the Two Types of Funded Accounts

Bulenox aims to build long-term relationships with futures traders, and I highly recommend them.

In this article, I will break down the benefits and unique features of each account type offered by Bulenox, to assist you in making the choice that best aligns with your trading goals and strategies.

PS: If you want to delve deeper into Bulenox, we’ve worked hard on drafting a thorough article, so take advantage of our insights:

Bulenox: Review and Complete Analysis of the Prop Firm

So, ready to explore the two types of funded account options at Bulenox? Let’s go!

The Two Types of Funded Account Options

Bulenox Account Option 1: With Trailing Drawdown

📌A Dynamic Drawdown

The trailing drawdown adjusts with your balance, maintaining a fixed distance based on your profit peaks.

📌Real-Time Drawdown Tracking

The drawdown update occurs in real-time with each trade executed during market hours and includes commissions.

📌Specific Loss Threshold Calculation

If you incur losses, your balance decreases, but the drawdown threshold is always based on your most recent profit peak.

📌The Limit Not to Be Exceeded

If you exceed the permitted drawdown threshold, the account is considered ‘burned out’, and the journey ends there.

Understanding Option 1 at Bulenox: Concrete Examples

The Dynamics of Trailing Drawdown for account option 1:

Let’s take the example of a trader using Option 1 at Bulenox, with an initial account of $100,000 and allowed to manage 12 contracts. This account is subject to a Trailing Drawdown of $3,000. This means the trader cannot lose more than $3,000 compared to his highest profit peak at any time.

Initial Situation:

Account balance: $100,000.

Drawdown limit: $97,000 (if it decreases, the account is blocked).

After the First Transaction:

Profit: $800. New balance: $100,800.

Drawdown adjustment: The new threshold becomes $97,800 (because the highest balance has increased).

If the Trader Continues:

Additional profit: $300 (not finalized).

Current balance (with open position): $101,100.

Drawdown threshold: Adjustment to $98,100 even if the exit order has not been executed.

In this example, even if the unrealized profit fluctuates, the drawdown threshold is set in relation to the last realized profit peak. This requires increased vigilance and real-time tracking of the drawdown, highlighting the importance of prudent and attentive management.

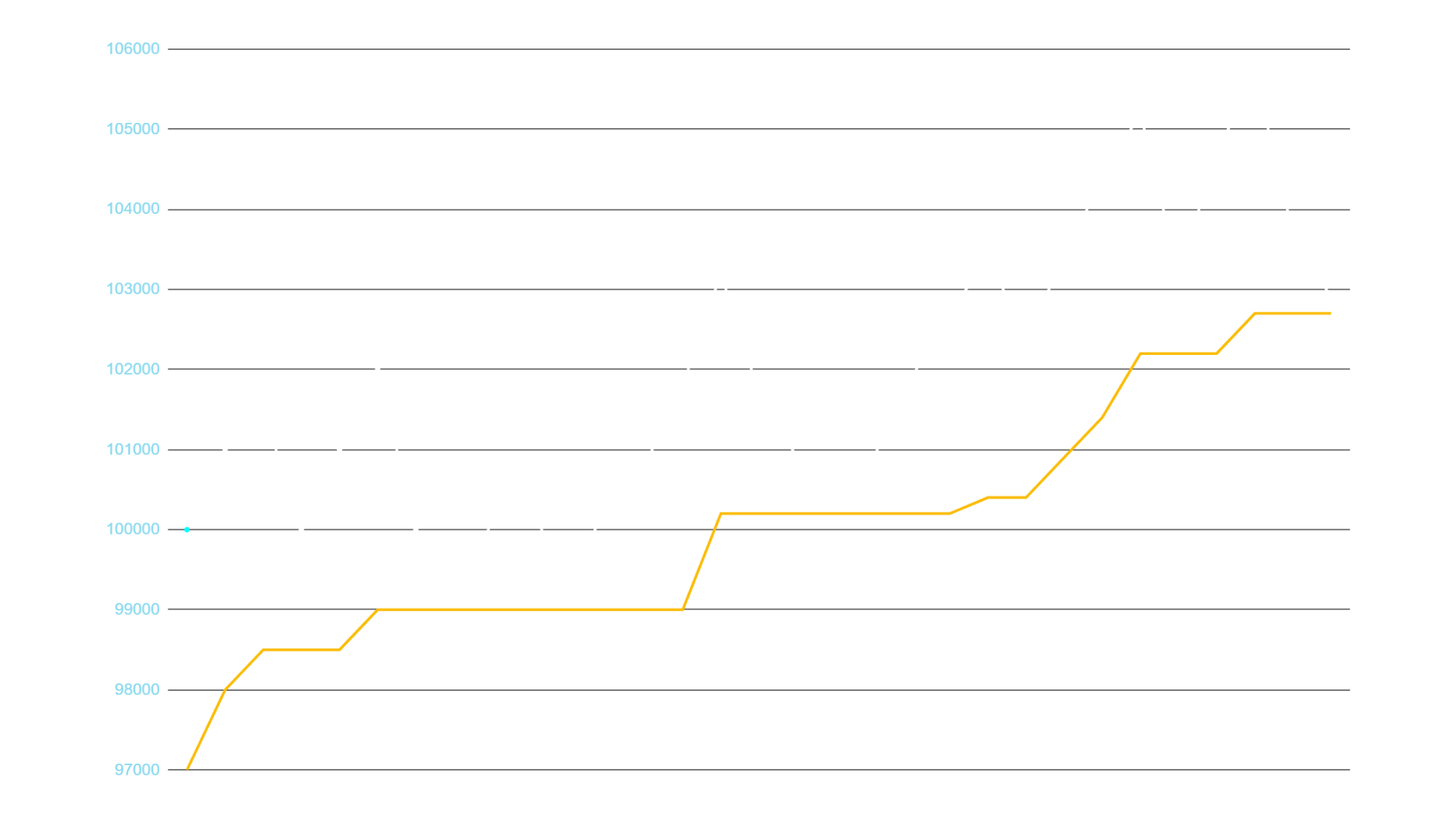

Exploring the Trailing Drawdown of Option 1 Through a Chart

Account Balance ($) which varies with each trade executed.

Trailing Drawdown ($): Dynamic and Adaptive, it varies with each new high.

Understanding the Trailing Drawdown is essential for risk management in futures trading with a prop firm.

This mechanism adjusts the authorized loss threshold according to the account’s performance, offering security while allowing some flexibility.

The associated chart illustrates how, after an increase in balance to $102,000 on day 2, the loss threshold adjusts to $99,000, creating a new ‘demarcation line’.

Key Point: Effective risk management is crucial to keep the balance above this threshold and avoid account closure. It is important to actively monitor your positions and your drawdown threshold in Rithmic to avoid being ejected.

Details of Bulenox Option 1 Accounts

I have meticulously broken down the specifics of each account offered under Option 1, for you to choose the one most aligned with your trading skills and requirements.

Bulenox Account Option 2: End Of Day Drawdown (EOD)

📌Static Drawdown

The concept applies a fixed loss threshold calculated from the end-of-day balance, ensuring a clear and unchanging risk limit.

📌End-of-Day Drawdown Tracking

The tracking of your losses is updated every day after the markets close, allowing you to effectively measure your daily performance.

📌Dynamic EOD Scaling Plan

This method recalibrates the number of contracts available for your trading based on your earnings, motivating you to continuously improve your results.

📌Control of Daily Loss Threshold

Dépasser la limite de perte quotidienne entraîne la suspension du compte, marquant une pause nécessaire dans tes activités de trading.

Here is an example to understand Bulenox’s Option 2

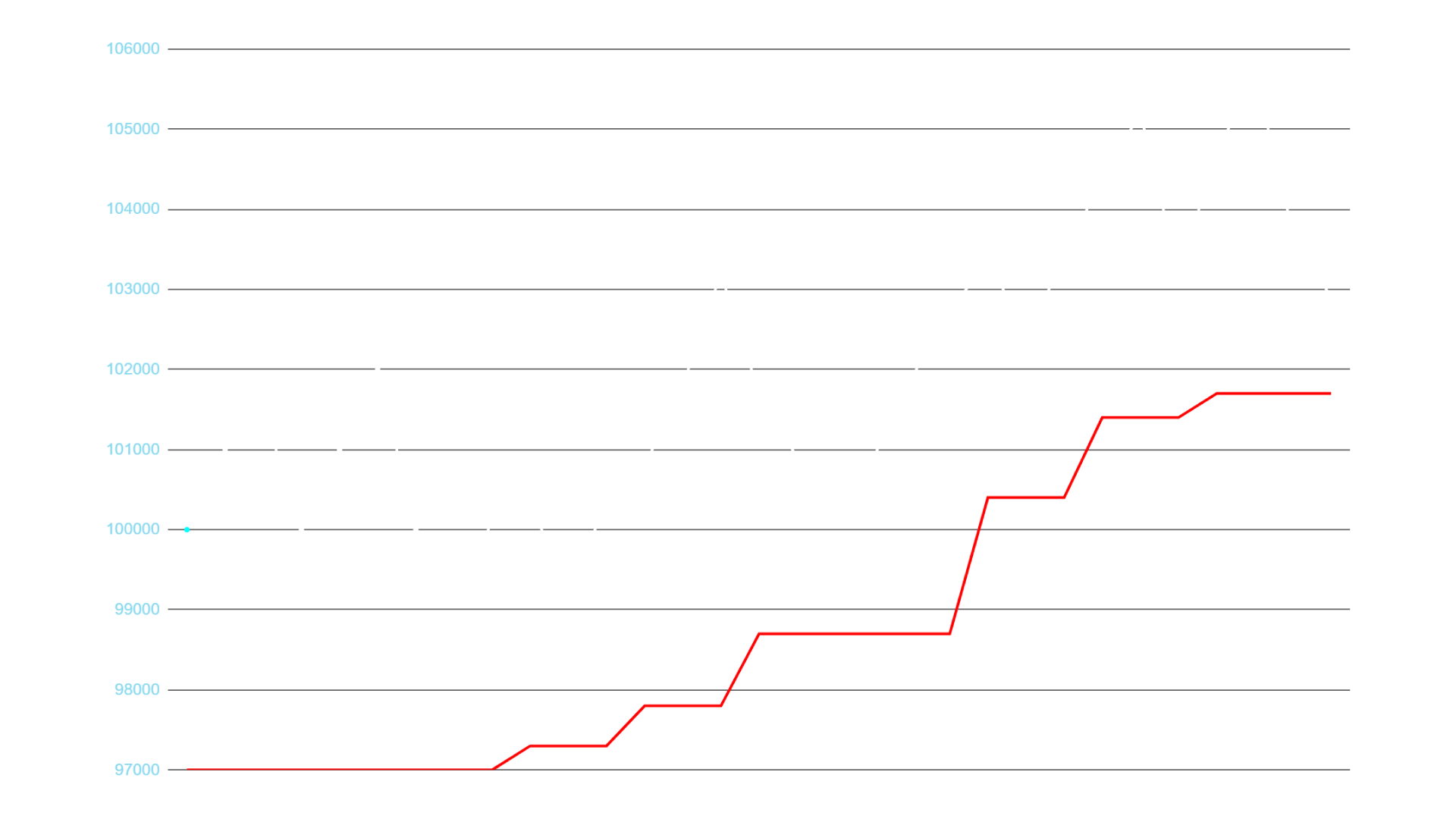

Example for an EOD 100K Account Supported by a Chart

Let’s take an example where you use Option 2 at Bulenox, with an initial account of $100,000. This account is governed by an End Of Day Drawdown (EOD) of $3,000.

Account Balance ($) varies with each trade executed.

The Static Type EOD Drawdown updates at the end of the day and remains unchanged the next day, regardless of P&L fluctuations. Its calculation is redone at the end of the day.

Initial Situation:

- Account balance: $100,000.

- EOD drawdown limit: $97,000 (if your balance falls below this amount at the end of the day, the account is locked).

Progress up to Day 3:

- You trade actively, but at the end of the day, your balance does not decrease significantly.

- End-of-day balance up to Day 2: remains above $97,000.

On the 3rd Day:

- After a successful day, your closing balance increases.

- End-of-day balance: $100,300.

- EOD Drawdown Adjustment: The safety threshold now rises to $97,300, adapted to the new end-of-day balance.

Note: In this scenario, the Static Type EOD Drawdown ensures stability by only changing the loss threshold when the closing balance increases. Therefore, even if you performed well on Day 3, it is imperative to continue monitoring this threshold closely. Exceeding this fixed threshold in the following days can lead to the suspension of your account, highlighting the necessity to remain vigilant and keep your performance above this critical line.

Understanding the Dynamic EOD Scaling Plan

At Bulenox, for accounts with a Scaling Plan, your trading potential evolves based on your performance. In essence, the number of contracts you can trade adapts based on your results, with the possibility to increase your speculative capabilities as your profits grow.

Here’s how it works:

- For starting accounts at $10,000, you have a solid base of 5 micro-contracts.

- At $25,000, begin the journey with up to 3 contracts, which can increase to 4 once you surpass $1,500 in profits.

- More substantial accounts, like those at $50,000 or $100,000, offer even more flexibility, allowing you to manage an increasing number of contracts as your balance grows.

And it doesn’t stop there. With accounts up to $250,000, you can unlock exceptional trading potential, with up to 25 contracts available depending on your performance.

These are their scaling plans according to the chosen accounts:

EOD 10K Account

Starting capital: $10,000

Scaling Plan

No scaling

(Max 5 micro contracts)

EOD 25K Account

Starting capital: $25,000

Scaling Plan

- $0 – $1,500 ⇒ (Max 2 contracts)

- $1,501+ ⇒ (Max 3 contracts)

EOD 50K Account

Starting capital: $50,000

Scaling Plan

- $0 – $1,500 ⇒ (Max 2 contracts)

- $1,501 – $4,000 ⇒ (Max 4 contracts)

- $4,001+ ⇒ (Max 7 contracts)

EOD 100K Account

Starting capital: $100,000

Scaling Plan

- $0 – $2,000 ⇒ (Max 3 contracts)

- $2,001 – $3,000 ⇒ (Max 5 contracts)

- $3,001 – $5,000 ⇒ (Max 8 contracts)

- $5,001+ ⇒ (Max 12 contracts)

EOD 150K Account

Starting capital: $150,000

Scaling Plan

- $0 – $4,000 ⇒ (Max 5 contracts)

- $4,001 – $8,000 ⇒ (Max 8 contracts)

- $8,001 – $12,000 ⇒ (Max 10 contracts)

- $12,001+ ⇒ (Max 15 contracts)

EOD 250K Account

Starting capital: $250,000

Scaling Plan

- $0 – $5,000 ⇒ (Max 6 contracts)

- $5,001 – $12,000 ⇒ (Max 12 contracts)

- $12,001 – $20,000 ⇒ (Max 18 contracts)

- $20,001+ ⇒ (Max 25 contracts)

The Daily Loss Limit of Bulenox’s EOD

Account At Bulenox, the daily loss limit defines the maximum amount you can lose each day. Calculated from your gains and losses, it also includes commissions and all transactions, whether executed or not, in each trading session from 5:00 PM to 4:00 PM Central Time. You can easily track this limit via the RTrader platform.

Here are the daily loss limits according to your account size:

- For a $10,000 account: $400 per day limit.

- For a $25,000 account: $500 per day limit.

- For a $50,000 account: $1,100 per day limit.

- For a $100,000 account: $2,200 per day limit.

- For a $150,000 account: $3,300 per day limit.

- For a $250,000 account: $4,500 per day limit.

If you reach this daily loss limit, your account will be suspended until the next trading day. This suspension is not a rule violation but a safety measure to protect your capital. Regular operations will resume at the start of the next trading session.

After qualification, for the main account:

Daily loss limits will be removed when the maximum drawdown threshold reaches the initial account balance. (For example: $103,000 on a $100,000 account).

Activation Fees Details for Master Accounts Options 1 and 2

With Bulenox’s Master Accounts Options 1 and 2, you benefit from a simplified cost structure: there are no monthly fees. Instead, you pay unique activation fees at the start, covering both data flow and maintenance fees. The activation cost varies depending on the account size you choose. Here are the rates:

Conclusion on the Two Account Options at Bulenox

Bulenox offers you two strategic choices that can shape your futures trading career: Option 1 with Trailing Drawdown and Option 2 with EOD Drawdown accompanied by a scaling plan.

Option 1 – Trailing Drawdown: Suitable for traders who can handle constant pressure, this option acts like a Damocles sword, adjusting the authorized loss threshold based on your highest balance reached. This means your past success raises the bar, pushing you to maintain or improve your performances without compromising your previous gains.

Option 2 – EOD Drawdown with Scaling Plan: This option is better suited for traders who prefer stability and predictability. With a fixed loss threshold calculated at the end of the day, it provides a clear risk structure and allows you to plan your trades with a clear view of your daily limits.

The qualification account is your first step to getting acquainted with the NinjaTrader trading platform’s features and to test your strategies under real conditions. This phase will help you determine which Master account best suits your trading style and financial aspirations.

Whichever option you choose, Bulenox is there to support every step of your trading journey. Take the time to evaluate your needs, strategies, and risk tolerance to make the wisest choice. With Bulenox, build your own path to trading success.

Now you know the two account options offered by Bulenox, allowing you to approach the futures markets according to your own trading style. Whether you are tempted by the flexibility and challenge of Option 1’s Trailing Drawdown or prefer the consistency and predictability of Option 2’s EOD Drawdown, Bulenox is ready to meet your needs.

Now, it’s your turn to act. If you are tempted, do not miss the opportunity to start with favorable conditions thanks to our Bulenox Promo Codes available HERE.